Wall Street experience

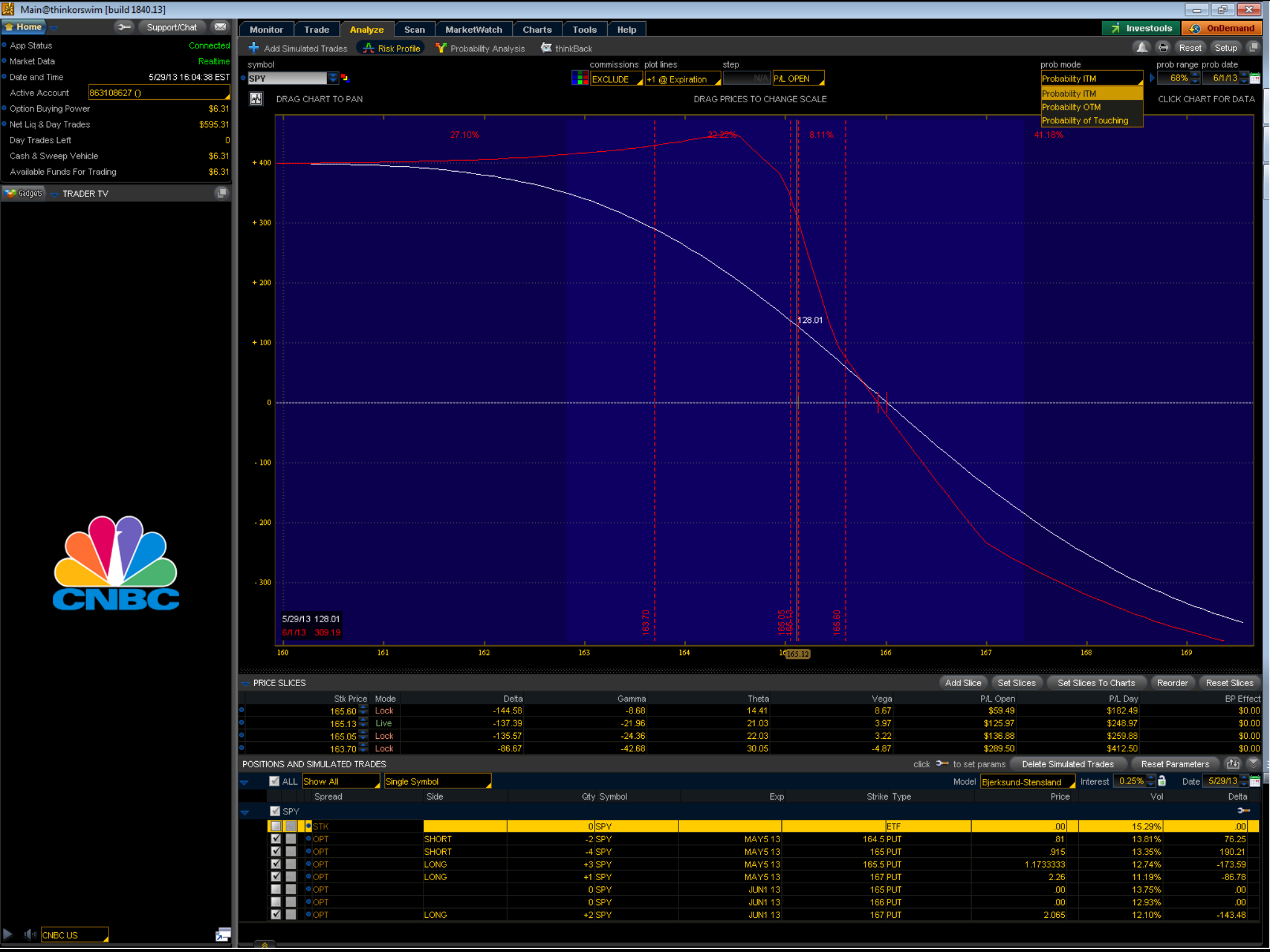

Above: Diagonal put spread on SPY ETF(Exchange Traded Fund) using Ameritrade’s Think or Swim Platform.

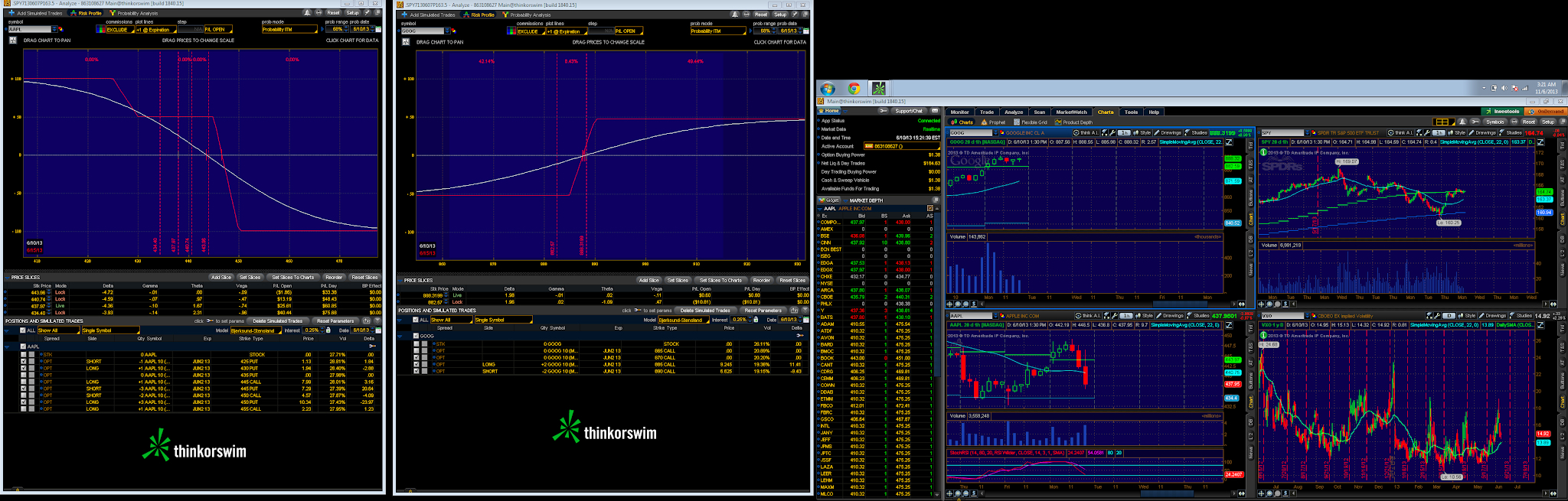

Above: Vertical spreads for two different stocks. One is a call spread and the other a put spread to hedge Incase I’m wrong about market direction either way. Both use time decay to my advantage and a few dollars in the money to compensate for any price fluctuations.

Wealth Mentors by Mariam MacWilliams

I did a U.S stock options trading course by Marriam MacWilliams in 2011. You can read more about her at these links:

My Options Strategies include both singles and spreads for call and put options. Spreads include:

- Vertical Spreads

- Diagonals

- Butterfly

My ETF picks:

- SPY

- GLD

- SLV

My Stocks picks:

- Apple

Preferred Trading Software & Broker

Think or Swim by TD Ameritrade

Technicals

- 30 daily/hourly SMA (standard moving average)

- 15 day/hourly SMA

- 7 day/hourly SMA

Fundamentals

Moody: 7-10 Bullish, 1-5 Bearish

Forecast

Bullish for the U.S economy (SPY ETF) for the next 20 years. Obviously this is a long term forecast that would include fluctuations but the overall market movement is up.